Hi Ariane,

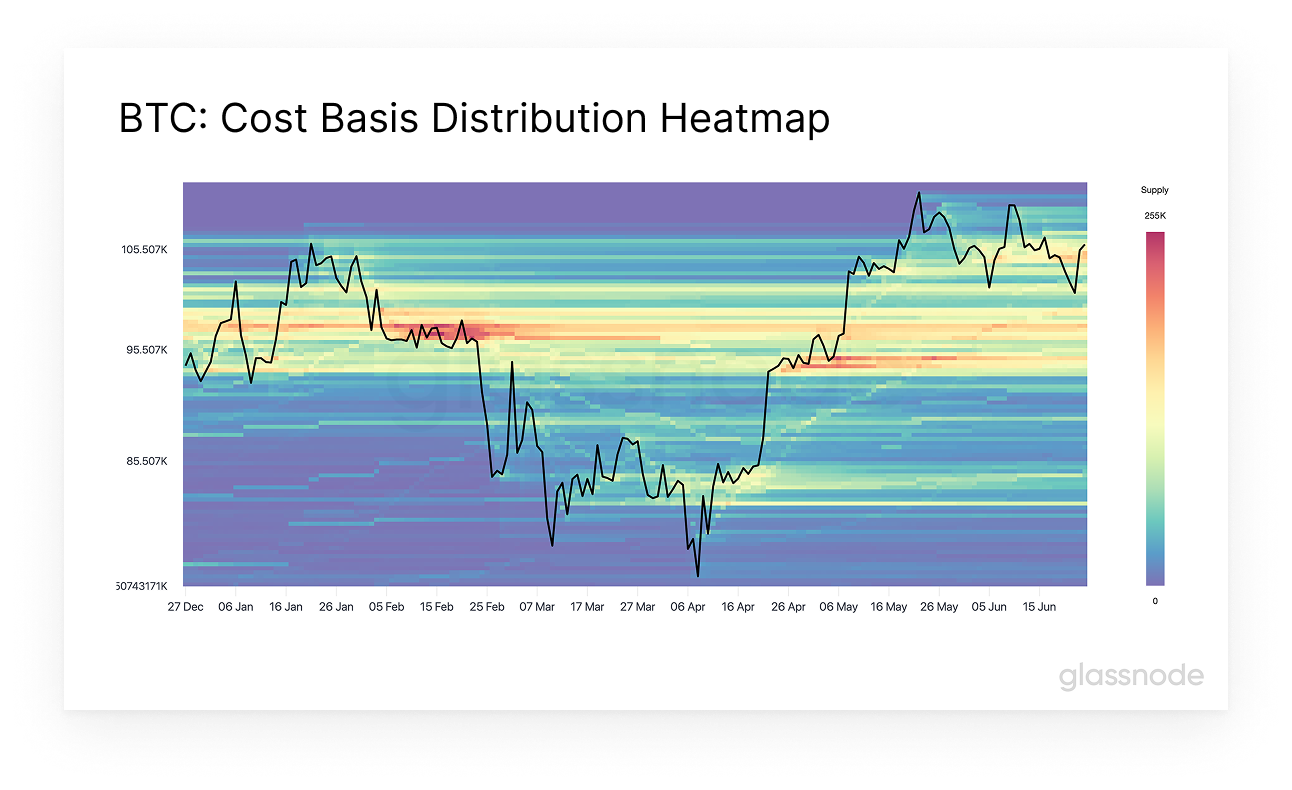

Since its introduction in November, Cost Basis Distribution (CBD) has quickly become one of the most widely used Glassnode tools for understanding investor positioning and sentiment. We've now rolled out a major upgrade! | | | CBD is now a standalone metric in Studio | with full-resolution charts, allowing detailed, high-fidelity analysis. | | | CBD is now a standalone metric in Studio | with full-resolution charts, allowing detailed, high-fidelity analysis. | | | Improved chart precision | Hover over any range to view the supply held at that price level | | | Improved chart precision | Hover over any range to view the supply held at that price level | | | Further expanded asset coverage | Now available not only for BTC and ETH, but also for SOL, TRON, XRP, BNB, DOGE, TON, and hundreds of ERC-20 tokens. | | | Further expanded asset coverage | Now available not only for BTC and ETH, but also for SOL, TRON, XRP, BNB, DOGE, TON, and hundreds of ERC-20 tokens. | | | | | 💡 Available to all Glassnode accounts for a limited time! | | | | | Get clarity on market dynamics with a free Glassnode account |  | | | Investor Sentiment | Changes in cost basis reveal how market psychology evolves throughout cycles – highlighting confidence, caution, or capitulation. | | | Risk Management | Monitor where investors are positioned in terms of unrealized gains or losses – key for anticipating market pressure points. | | | Conviction & Positioning | Identify patterns of averaging down or reduced participation to assess conviction and strategic posture. | | | Market Structure | Visualize clusters of cost basis to identify where support or resistance may form. | | | | |